- Introduction

- Chapter 01

- Chapter 02

- Chapter 03

- Chapter 04

- Chapter 05

- Chapter 06

- Chapter 07

- Chapter 08

Introduction

The Definitive Guide To Repairing Your Credit

This credit repair guide has been written for information purposes only. Every effort has been made to make this guide as complete and accurate as possible. However, there may be mistakes in typography or content. Also, this guide provides information only up to the publishing date. Therefore, this should be used as a guide – not as the ultimate source.

The purpose of this guide is to educate. We do not warrant that the information contained in this guide is fully complete and shall not be responsible for any errors or omissions.

The author and publisher shall have neither liability nor responsibility to any person or entity with respect to any loss or damage caused or alleged to be caused directly or indirectly by this guide.

This guide offers financial and legal information and is designed for educational purposes only. You should not rely on this information as a substitute for, nor does it replace, professional financial or legal advice.

Many people cringe when they hear the word credit. The credit system is complicated, scary, and sometimes might even appear overwhelming. But it can be understood and even controlled if you possess the right knowledge.

With this guide in your hands, you are about to become a credit master. You will know exactly what your credit scores are based on and how you can control them. You will learn the secrets the credit bureaus don’t want you to know about their computers, systems, and tainted past. You will uncover unethical creditor tactics that are being used right now to ruin your credit. You will even have access to credit bureau dispute methods, letters, and advanced letters which will all help you remove inaccurate items from your credit report.

This guide is designed to give you a step-by-step process of understanding and fixing your credit. You will be able to first understand the credit system itself, then know everyone’s roles in the credit system, and, finally, you will be able to conquer your credit problems once and for all. You can have excellent credit and the credit system can be beaten. This guide will show you how.

Chapter 01

What is Credit & Why is Credit Important

Credit is defined as an agreement between a creditor or lender and a borrower in which the consumer assumes something of value in agreement to repay the creditor, based on certain terms.

Car dealers, banks, credit card companies, mortgage companies, signature loan companies, payday advances, even student loan agencies, are a few of many sources who extend credit to individuals.

When you apply for new credit, these creditors review your credit profile to determine your risk of repaying that debt. Based on your risk you might get approved or denied.

If you do get approved, the repayment terms will again be based on the quality of your credit profile. The better your credit profile and the higher your score, the better terms you will receive.

When your credit profile is damaged, you will be charged higher interest based on that risk. The rate of interest will vary based on many factors, but interest charges can be significant. One credit card company in 2009 even released a credit card with an 89% APR!

If you do get approved, the repayment terms will again be based on the quality of your credit profile. The better your credit profile and the higher your score, the better terms you will receive.

When your credit profile is damaged, you will be charged higher interest based on that risk. The rate of interest will vary based on many factors, but interest charges can be significant. One credit card company in 2009 even released a credit card with an 89% APR!

Importance of Credit

Your life is your credit. If you have ever been denied a loan or even a job due to your credit, then you already know the importance your credit profile has to your life.

Most of the payments you pay each month are affected by your credit quality. Home loans, rent, car payments, credit cards, installment loans, car insurance, cell phones, health and life insurance, and even monthly utilities are all based on the quality of your credit.

From the payments you pay each month, such as whether you rent or own your dream home are based solely on your credit quality. New employers are even relying on credit to help make hiring decisions. It is impossible to hide from your credit. And as more companies rely on it to gauge risk, the importance of your credit profile is ever increasing.

But credit is also very scary. Most consumers don’t know how credit works or even what that magical credit score really means. One thing is for sure, there is a dramatic difference in your quality of life when you have bad vs good credit.

Life with Bad Credit

You can live with credit issues. But every year those issues will cost you tens-of-thousands of dollars, making it hard to survive and near impossible to save money for your future.

This is one of the fundamental reasons the United States savings rate has stayed under 1%. Many consumers don’t have the extra money to save due to paying tens-of-thousands of dollars each year in outlandish interest charges.

I have spent many years in the finance industry. During this time, I have done many financial reviews with clients and most of my clients had no idea how much their credit was really costing them.

Sure, they knew that bad credit was causing issues with them getting approved for new credit. What they didn’t know, just like most consumers, is how much credit impacts their day to day lives.

Bad credit ruins lives. This is one of the most shocking but REAL statements you might read in a while. The difference between living life and struggling to survive is based completely on credit quality.

Let’s look at a car as a simple example. Most people in society today need a vehicle to get around. We require it to get to our jobs, our kids to daycare, or just to get to the store. There are an estimated 250 million car owners in the U.S. alone, so chances are pretty good you are one of them or know someone who is.

Many car owners chose to finance their vehicles and pay monthly payments until the debt is paid off. Car loans are offered to consumers based on their credit history and their credit scores, like most other loans.

And based on those credit factors, risk will be determined by the auto lender and an interest rate will be established for the consumer to pay back that loan. The payments will then be established based on the loan amount, interest rate, and term of the loan.

With good credit, you will get approved for a longer term and better interest rate. With bad credit, you will pay much greater interest on a shorter term, making your payments much higher.

Okay, so maybe you already knew all that. Many consumers do, but most don’t know how much that extra interest and shorter terms is really costing them.

A $20,000 car loan with good credit will cost approximately $322 monthly. This is based on a 5% interest rate for 72 months. The exact same $20,000 car loan with bad credit will cost approximately $541 monthly. This is based on a 21% interest rate for 60 months.

This is the same car, but one is costing $219 more EVERY month. The person with good credit will pay $23,184 for their car. The consumer with bad credit will pay $32,460 for the same car. That’s a $9,276 difference. This means the same car will cost the consumer with bad credit 46% more than the one with good credit.

These examples are not extreme. These are based on common interest rates on a $20,000 auto loan.

Rent and home expenses are another area where customers get taken for great amounts of interest.

A $100,000 mortgage costs a good credit consumer $577 monthly and $207,720 over 30 years. The same home would cost a family with challenged credit $841 monthly and $302,760 over 30 years.

The consumer with good credit will pay $264 less per month and save $95,040 over the lifetime of the loan. That means the person with bad credit will pay $95,040 more in interest for a $100,000 loan, due to their credit.

Credit cards might cost $116 more monthly based on credit. Utility payments are higher, insurance payments could be double, and many other regular family expenses are certainly more.

Most people know credit has an adverse effect on their life. But the truth is, bad credit controls their lives. Outrageous amounts of interest are being charged each and every month. That debt and those higher payments strap most families, forcing them to live paycheck-to-paycheck.

If even one emergency arises, many consumers in this position are susceptible to a total financial catastrophe. With bad credit, their lives are just like a house of cards waiting to collapse.

Consumers with credit issues don’t have high open limits to use in case of emergencies. When a transmission goes out or a child needs emergency dental treatment, payday loans become about the only option to get money in a pinch. The rates on those are extremely high, making them almost impossible to pay off.

Life is challenging with bad credit, really challenging. With no available credit, one emergency can wipe you out. And there is no extra money each month, due to hundreds-of-dollars each month spent on excessive interest charges.

Many then are so caught up with financial survival, they forget about how innocently it all began. Instead, they are caught in a trap which few recover from.

The Bad Credit Trap

I call this the Bad Credit Trap. This is a trap most consumers will never get out of. The system won’t naturally allow them to recover.

In my career, I have heard many clients tell me how good their credit was before it went bad. But I have never had even one client with good credit tell me their credit was bad and it magically got better.

Most with bad credit never recover. That is a fact. And the reason is that the system is against them from the start. People with credit issues are not in this situation because they are bad people. They are sucked into a credit trap that they don’t know how to recover from.

Credit problems usually stem from an uncontrollable event. Some have a car crash or medical issue that compiles medical bills. Many others go through divorce or have credit cards too young, leading to issues where a default or late payment occurs.

There are thousands of reasons things happen, but let’s just say life happens. And when life happens, and even one account gets paid late, a downward credit spiral then begins. Even if the late payment was for one credit card, most other card companies will claim their risk is higher.

Several things start to happen at this point. First, many creditors will lower their limits. If a creditor lowers the high credit limit on an account, the credit score always goes down. This is due to 1/3 of your credit score being based on your Available Credit, which you will find more about in chapter 3.

Now the person has less available credit, right when they need it most. Plus, with lower available credit, they will face more overdraft fees. Credit scores continue to drop, and risks increase for all other accounts, creating a vicious downward spiral that is hard to recover from

Now creditors will start to increase interest rates due to the increased risk. All creditors can’t do this, but in the fine print, many reserve the right to do just this. The higher rates mean the payments also increase. The consumer is now faced with higher payments on several of their accounts, not to mention having to pay their original late fees.

Eventually, this leads to late payments. Then things start to get bad, fast. In a very short period of time, credit that once was good is now left destroyed.

This means all new credit the consumer applies for will only be approved at high risk rates. This costs hundreds more dollars every month and radically deteriorates the consumer’s quality of life, for many years to come.

Most people continue to then struggle all their life with this cycle. The high interest rates and payments leave them living paycheck-to-paycheck. And they commonly go late on their payments after that, as they struggle to pay outlandishly high interest rates and payments.

This is the Bad Credit Cycle. Many times, it starts with one unavoidable late payment. But in the end, it costs most people any chance of having a healthy financial future.

Life with Good Credit

Life with good credit is an entirely different story. Many people believe they want to be rich, financially. But what many don’t realize is that their fantasy life has less to do with being rich and more to do with having good credit.

Mercedes Benz is a great symbol of car luxury. Many have dreams of owning one. In their dreams, they fantasize about being rich and driving a Mercedes. With good credit, a brand-new Mercedes Benz can cost $326 monthly. Even a luxury home can be financed for less than $1,000 a month in many places in the United States.

The secret to wealth, in many cases, has less to do with being rich and more to do with credit quality. Even a crazy dream like walking into a store and buying whatever you want or buying a car on your credit can be reached if you have good credit, and even if you are not wealthy.

Good credit won’t stand in the way of getting a good job or getting approved for new credit at 0% interest rates. Good credit makes living the American dream of home ownership a reality. It even makes driving a Corvette or a Harley Davidson practical.

Credit lines are issued to consumers based on their credit quality. With good credit, it is common for consumers to receive credit lines and credit cards for $10,000 or higher. In many cases the interest on those cards is also less than 3%, making them ideal for many situations, especially emergencies. Good credit creates peace of mind for this reason.

Let me tell you a little lender secret here. Good credit clients in most businesses are treated better than those with credit issues. Auto dealers, banks, mortgage companies may try not to, but most do treat good credit customers superior.

I don’t agree with this at all, but I have seen it play out this way countless times. Good credit customers are offered better deals than those with credit issues.

The main reason is that good credit buyers are stereotyped as smart, intellectual, educated, people who do their research and will leave in a minute if they think they are being taken advantage of. This fear has most sales managers coddling good credit prospects.

In society today, good credit is like being rich. When you have it you are treated better, can spend more and pay less, and absolutely afford to have the life of your dreams.

Good credit makes accomplishing your biggest life’s goals much easier. I will pull back the curtain and reveal the secrets of the credit systems, secrets behind your credit scores, and even a proven system to correct your credit in the following chapters.

Chapter 02

Your Role in the Credit System

As important as your credit is, you sure hope that someone is ensuring your credit report reflects legitimate and accurate information. This is the common belief I have always heard from clients. They believe that someone, maybe the government, the bureaus, the creditors, but someone, is ensuring that reported data is accurate and correct.

But the sad truth is, nobody is watching this for you at all. You are the ONLY person involved with your credit who benefits from your credit profile being positive and accurate.

The credit bureaus, like many companies, do have to abide by certain federal and state laws. They are also required to investigate credit disputes based on certain criteria found in laws like the Fair Credit Reporting Act. But the credit bureaus don’t question what creditors report, unless they themselves are questioned on it.

Creditors also must abide by state and federal laws. But most reporting creditors don’t have divisions within their companies where they validate what they are reporting.

The credit bureaus and creditors do have one thing in common regarding reporting of your data. They both make more money the worse your credit is.

To investigate this more, let’s look at the roles everyone plays in the credit reporting process.

The Credit Bureaus

The Fair Credit Reporting Act refers to the credit bureaus as Consumer Reporting Agencies or CRAs. The “Big 3” credit bureaus are TransUnion, Equifax, and Experian. There is a fourth reporting CRA known as Innovis, which creditors rarely use.

These are private for-profit companies who make money by collecting and selling consumer information. Let’s look at the history of each of these four Consumer Reporting Agencies.

TransUnion

TransUnion got its start back in 1968 as a holding company created by Union Tank Car Company. The following year, in 1969, TransUnion purchased Credit Bureau of Cook County (CBCC), entering the credit business.

In subsequent years, TU continued to purchase major cities’ credit bureaus and exclusive rights with many of their creditors. Their vision was to create a national credit database from what then was not more than simple file cards. TU obtained over 3.5 million of those file cards with their purchase of CBCC alone and continued to combine millions more to create the database they have today.

Trans Union continued to grow and expand their business, most recently purchasing True Credit in 2002. This was their first attempt to sell to consumers directly and has been an ever-increasing aspect of their business ever since.

Today TransUnion is based out of Chicago, Illinois, and operates over249 offices nationwide and offices in 25 countries on 5 continents.

Equifax

Equifax is the oldest and largest credit bureau in existence today. They were originally founded in 1898, 70 years before the creation of TransUnion.

Two brothers, Cator and Guy Woolford, created the company. Cator got the idea from his grocery business, where they collected customers’ names and evidence of credit worthiness. He then sold that list to other merchants to offset his own business costs.

The success led Cator and his attorney brother, Guy, to Atlanta to start what would become one of the most powerful industries in existence today.

Retail Credit Company was born, and local grocers started using the Woolford service, which expanded rapidly. By the early 1900s the service had expanded from grocers to the insurance industry.

Retail Credit Company continued to grow into one of the largest credit bureaus by the 1960s, with nearly 300 branches in operation. They collected all kinds of consumer data, even rumors about people’s marital lives and childhood. They were also scrutinized for selling this data to just about anyone who would buy it.

In the late ‘60s, Equifax started to compile their data onto computers, giving many more companies access to purchase this data. They also continued to purchase many more of their smaller competitors, becoming larger and also attracting the attention of our Federal government.

In response, the US Congress met in 1971, and enacted the Fair Credit Reporting Act. This new law was the first to govern the information credit bureaus and regulate what they were allowed to collect and sell. Equifax was charged with violating this law a few years later and even more government restrictions were implemented.

Equifax was no longer allowed to misrepresent themselves when conducting consumer investigations and employees were not given bonuses anymore based on the negative information they were collecting, which was standard practice in the past.

It is alleged that due to the tarnished reputation all this left on Retail Credit Company, they changed their name to Equifax (Equitable Factual Information) shortly after in 1979.

Throughout the 1980s, Equifax along with Experian and TransUnion, split up the rest of the smaller credit rating agencies amongst them, adding 104 of those to Equifax’s portfolio. They then continued to grow, taking aligning with CSC Credit Services and another 65 additional bureaus.

Equifax has continued to grow, now maintaining over 401 million consumer credit records worldwide. They also expanded their services to direct consumer credit monitoring in 1999. Today Equifax is based out of Atlanta, Georgia, and has employees in 14 countries.

Experian

Experian was formerly a division of TRW, an automotive electronics giant. TRW was originally founded in 1901 as the Cleveland Cap Screw Company. They started producing screws and bolts and grew to produce many parts for the aviation and automobile industry.

In the early 1960s, TRW started a consumer credit information bureau, collecting and selling consumer data, and eventually became known as TRW Information Systems. TRW Information Systems continued compiling data and were the first to start offering consumers direct credit report access in 1986.

In 1991, rampant problems started appearing with TRW reported credit data. Thousands of people in a town in Vermont had tax liens inaccurately reporting against them. Similar cases started appearing in the entire northeast, forcing the deletion of countless tax liens across the states of Vermont, Rhode Island, New Hampshire, and Maine

Dozens of lawsuits were filed against TRW, claiming sloppy procedures to create credit files, lack of response to consumer complaints, and re-reporting previously deleted incorrect data. All cases were settled out of court.

Then TRW created a database known as the Constituent Relations Information Systems (CRIS). This system’s sole purpose was to gather personal data on 8,000 politicians who had an opinion of TRW.

In 1996, TRW was purchased for over 1 billion dollars by a private group of investors, and then acquired by CCN, the largest credit reporting company in the United Kingdom. Their name was also changed to Experian.

Today, Experian offers their services in over 65 countries, employing over 15,000 people and has their main headquarters in Dublin, Ireland. Their stock is sold on the London Stock Exchange.

Innovis

Innovis once was ACB Services and was founded in 1970. Innovis is not used by many creditors, at all. Verizon is one of the main creditors who still do use Innovis. But Innovis is said to be the first CRA to use databases and automation to capture and store consumer data.

Fannie Mae and Freddie Mac, as of 2001, started requiring that mortgage companies also report to Innovis, which was a huge step for their future. Innovis offers two main services including a list of people who have recently changed addresses and another list of consumers who have a challenged credit history.

Since 1898, when Equifax began, companies have been collecting and selling consumer data. Today the three major credit bureaus all house hundreds-of-millions of profiles for individual consumers.

How this data is valued is another interesting and revealing point to discuss.

Why the Credit Bureaus Love Bad Credit

Your credit profile is made up of data collected by creditors, then reported to the credit bureaus. The bureaus then make a profit by selling this data in reports, leads, and other methods to creditors for the purpose of issuing new credit or soliciting you for credit.

For example, when a creditor, such as CHASE, wants to offer you new credit, they purchase a data list from the credit bureaus. This list might be of consumers with credit scores from 550-620, for example. The bureaus then profit by selling that list to CHASE and CHASE will then use that list to send mailers to you soliciting you to apply for their credit card.

In the data selling world, credit challenged consumers with subprime credit are always more valuable. This means a creditor will pay more for a list of consumers who are 30 days late on their mortgage than a consumer with a perfect pay history.

This is simply due to supply and demand. Very few companies want the perfect pay history consumers, so this data has a low value. But there are a significant amount of subprime companies who will pay top dollar for this data.

Subprime credit card companies, auto and home loan, credit repair, loan modification, short sale companies, and even debt consolidation are just a few company types who pay big money for these types of leads.

Companies also pay more for “triggers” or “selects” for consumer leads. This means they pay more for bankruptcy leads, high credit card balances, late payments on credit cards, COLLECTIONS, 30-90 day late payments, foreclosures, and even late payments on mortgages.

CHASE won’t pay much for a list of good credit customers. In comparison, a bankruptcy company will pay a lot more for a list of consumers who filed bankruptcy within the last 30 days. That list is much more specific, and would cost about TWICE as much from the bureaus.

So the credit bureaus actually make MORE money the worse your credit is. This is NOT an opinion, but a clear FACT. It is NOT in the credit bureaus’ best interest to help ensure your credit report is accurate. Actually, they make more money if your credit is bad.

The only reason they allow you to dispute accounts on your report is that they are obligated by law to do so. And these laws were created due to the rampant credit bureau abuse and mishandling of consumer data.

The credit bureaus are not your friends and they do not benefit by you having a positive credit profile. So don’t expect them to be looking out for the accuracy of your credit profile.

Your Creditors/ Data Furnishers

Creditors in the credit equation are known as Data Furnishers. They are the agencies who offer financing to consumers, then report the pay histories back to the credit reporting agencies or the credit bureaus.

Some other personal information is also given by creditors, including consumers’ names, date of birth, social security number, address, prior addresses, current employer, previous employer, and even inquiries for credit applications used to determine spending patterns. Everything they can collect from the consumer and report back to the bureaus by law, they do collect and report.

Most data furnishers are private and public for-profit companies. They make money based on lending to consumers and earning a return through interest. This interest is based on risk. The higher your risk, the more you pay in interest. And in most cases, your interest rate is tied directly to your credit scores. The lower your scores, the higher your interest rate will be.

Credit card companies don’t make anything on 0% cards. But the minute you go late on your payment, your interest rate skyrockets. This is where they make their money, on 13% and higher interest rate charges.

A published study shows that some companies make 3 times more money on their subprime clients as they do their prime clients. The worse your credit is, the more your creditors charge, and the more profits they make from your account.

This is why your creditors monitor your credit report frequently. Any decrease to your score or adverse information on your report can then be used to raise your interest rates, even if you didn’t go late on that creditor’s account.

But notice, you have probably never had a creditor monitor your credit then politely inform you of misreported information on your report. This is because the worse your credit is, the more money your creditors will make. And you will find that credit errors are rarely in your favor, for the same reason.

BOTH your creditors and the credit bureaus make more money the worse your credit is. It is in their benefit that your credit is bad, so don’t expect them to spend a lot of time ensuring that your credit profile is accurate and positive.

Due to prior credit bureau abuse and misreporting of information, you are entitled to one free copy of your credit report each year. This is because the federal government is not monitoring your report for accuracy, but instead, they are depending on you to self-regulate your own credit profile.

You are expected to get a copy of your report each year to make sure it is accurate. When you do this, you will always want to check all the data very carefully on your report for accuracy. YOU are the ONLY person dealing with your credit who benefits by having an accurate and positive credit history.

So take it upon yourself to get a copy of your free report, dispute any inaccurate information, and manage your credit wisely. You are the only one who benefits when your profile is positive and accurate, don’t forget this.

Chapter 03

How Do Credit Scores Work?

You are probably familiar with your credit score. Nowadays you can gain access to your credit reports and your credit scores much easier than in the past. This is because of government regulations that are now giving consumers more access to this once highly secretive credit system.

Knowing your credit score is important, but knowing how your credit score works is essential. Once you know and understand the components of your credit score and how they work, you will then be able to make small adjustments and make radical increases to your scores.

The first thing to know is that there are many different credit scores in existence. Each of these is based on a separate credit scoring model.

The Different Credit Score Models

There are hundreds of different credit scoring models. Most of the commonly used models come from a company named Fair Isaac. This company does statistical calculations of risk and summarizes it in a numerical value, which is your credit score.

Fair Isaac creates scoring models which gauge a consumer’s risk in paying back a debt. To be more specific, their calculations are designed to gauge a consumer’s risk of going 90 days late on an account in the next 2 years. The greater your risk of going 90 days late, the lower your credit score will be.

Fair Isaac then sells their scoring models to the credit bureaus TransUnion, Equifax, and Experian. They also sell hundreds of other specialized scoring models to other industries. There are Mortgage Industry and Auto Industry Option scoring models, credit card models, banking industry models, global models, and hundreds more.

Many industries want their own specific models. This is why if you apply for a car loan or mortgage, they will always pull different credit scores than you will pull on your own.

For example, the Auto Industry Option scoring model rates six specific auto history accounts types heavier than all other accounts. If a person has a repossession, their Auto Industry score pulled by a car dealer will be less than if the consumer pulled their own consumer score.

The auto lenders care more about your past auto history more than anything else. So when they pull their score, any bad or good auto history will have a greater impact on your scores than on any consumer report you may pull. These variables are known by Fair Isaac as “scorecards”.

Credit card models will rate credit card late payments heavier than other models will. Each industry specific model will be impacted more if accounts are paid late or defaulted on within that specific industry.

There are also general models like Classic FICO and FICO 08 which are the models you can go online and pull your own score for. The credit bureaus even have their own score named Vantage Score. Altogether, hundreds of different scoring models are used. But, the underlying scoring calculations are the same, just modified slightly for each industry.

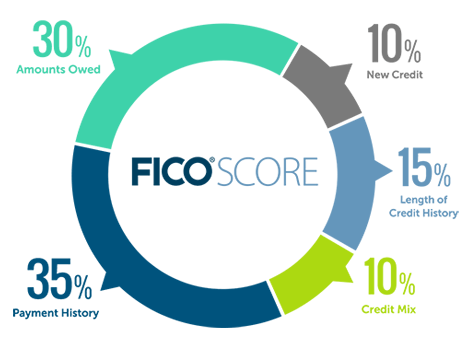

The Credit Score Breakdown

There are many credit scorecards in existence today. But the underlying principal components of all those models remain the same. Some will rate certain aspects of your credit scores higher, but the scores themselves are built on the same five ingredients.

Payment History-35%

Your payment history is the largest aspect of your credit score, as you might expect. In total, your pay history accounts for 35% of your total score.

This aspect of your total score calculation is based on your prior payment history with your creditors. Late payments, defaulted accounts, bankruptcies, and all other negative information on your credit report have the greatest effect.

The more recent the late payment, the greater the damage is to your credit score. If you pay late on your mortgage this month, the Mortgage Industry Option scoring model could drop your scores over 120 points. That is with only one 30 day late payment!

The scoring model is based on your potential to go 90 days late on an account within the next 2 years. Any recent late payments are a big reflection that you will default, and your credit score plummets as a result.

Your creditor cannot report you late unless you are 30 days late. But they will claim they need 10 days to process your payment. So don’t think just because you mailed your payment on the 25th day that they will not report you late.

Altogether, your entire history of payment counts for 35% of your total scores. The more positive accounts you have and the less negative means a much higher credit score.

Percentage of High-Credit Used- 30%

The second largest factor in your credit scores is the amount you owe in relation to your high credit limits.

If you are carrying high credit card balances, you can actually hurt your credit scores almost as much as paying the account late every month. This is because if you go late you affect 35% of your score, but if you use a high percentage of your available credit you affect 30% of your scores.

This is why we highly recommend to our clients that they get approved for new credit high limit credit. A high limit account will really open up the available credit on the report and increase the scores.

This aspect of your credit score has several different factors. The first factor is your relation of balances you owe on all of your accounts in relation to the credit limits on those accounts. Once again, this takes into consideration balances on all of your accounts combined. Your credit score also takes into account balances in relation to credit limits on your individual accounts.

For example, you will be scored higher if you owe 30% or less on your credit card accounts. This means if you have a credit limit of $1,000, you will have a higher score if you maintain a balance of $300 or less.

For revolving accounts, such as credit cards, you want to keep the smallest balances while still keeping a balance. Don’t pay the account to 0, and not use it. If you stop using the account, your credit score is not increasing. Pay it as close to 1% as you can, but make sure you keep your balances below 30%.

Your scores will also be lower due to higher balances on installment loans, car loans, mortgages, and other non-revolving accounts. This is why your credit scores will always be immediately lower if you open any of these accounts now. A new car loan, for example, will lower your scores once it goes on your report. How much lower depends on your spread of other accounts.

As your loans and mortgages are paid down over time, your scores will steadily increase. This is why one of the best things you can do for your credit is open accounts and pay them as agreed. Careful though you don’t want to pay those accounts down to zero too quickly, you won’t get credit for an account that has no balance and no payments due.

Your score will be affected by how many open accounts have balances, how much of your total credit lines are being used, and how much of a balance you have on installment loans, such as car loans. You can directly improve your credit scores by maintaining lower balances on your accounts or spreading balances over several different accounts. You can also get approved for new high-limit accounts to increase your scores.

Length of Credit History- 15%

Your “time in the bureau” accounts for 15% of your credit score. The older you are and the longer you have had credit accounts for, the higher the score. This is why it is near impossible to get to an 800 score at a young age. As you have more accounts throughout your life and your history grows over time, your scores will naturally increase due to this factor.

Being added as an authorized user to an account with a long pay history is another pay to increase your scores. Be careful how you do this. The new scoring models won’t give you credit for most authorized user accounts unless they are family members of yours.

If you do have a family member who has had positive open accounts open for some time, see if they will add you as an authorized user on one of their accounts. They have no risk, as you won’t be able to use the account unless they physically give you a card. But you will get credit on your reports, and this will increase your credit scores.

Accumulation of New Debt-10%

Accumulation of new debt accounts for 10% of your total credit score. This aspect of your credit score comprises how much new debt you are applying for. It takes into consideration how many accounts you currently have open, how long it has been since you opened a new account, and how many requests you have for new credit within a 12 month time period.

If you go out today and apply for credit, that creditor requests information from the credit bureaus. This counts as an inquiry on your report. If you have a lot of inquiries in a short period of time, your scores will be impacted.

If you apply for a mortgage today, your scores might drop one point. But, if you apply for a car, a mortgage, and a few credit cards this week, your scores could drop significantly. The same applies if you have twelve car dealers pull your credit, or if one dealer has twelve banks pull your credit. A lot of credit pulls in a short period of time will have a great impact on your scores.

Don’t apply for too much new credit in a short period. And don’t let a lot of different creditors pull your report while applying for big purchases. You should also monitor your credit report for inquiries and dispute any that you are not familiar with or feel should be removed.

Healthy Mix of Credit Accounts-10%

Your credit scores take into account the “mix” of credit items you have on your report. This part of your credit score is affected by what kinds of accounts you have and how many of each. The bureaus will score you higher if you have an open mortgage, 3 credit cards, 1 auto loan, and a small amount of other open accounts.

If you have a ton of credit cards, your scores will be lowered. If you have several mortgages, your scores will be lower. Any “unhealthy” account mix lowers your scores. The preferred number of credit cards is three. This means you will actually have a higher credit score if you have three open credit cards than if you have more or less than three open.

Don’t run out and cancel your cards just yet. Remember, 30% of your score consists of your balances in relation to your high credit limit. So keep your cards open, but focus on having three large balance cards for maximum impact. Maintain a healthy mix of accounts and this aspect of your credit score will be golden.

There are many different credit scoring models available for creditors. But the underlying makeup of the score is consistent. Now you know exactly how your credit score works. With this information, you can make even minor adjustments to how you use credit and see a major increase to your scores.

Chapter 04

How to Read Your Credit Report

There is only one true way to get a free copy of your credit report with no strings attached. You can only request your report online at www.annualcreditreport.com. You can also download the request form at www.ftc.gov/credit and mail it to Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Or you can call toll-free to receive your credit report at 1-877-322-8228. You should be able to download your credit report immediately on the Annual Credit Report website. It will take up to 15 days to receive your report if ordering by mail or phone.

You can also sign up for a credit monitoring service and receive a free report for 30 days. But you will be required with most to give your credit card information, then auto charged after that indefinitely, until you cancel.

These reports will update every 30 days, giving you constant access to your reports. This is great for constantly monitoring your credit for updates, changes, and errors.

There are many of these services credit monitoring services out there. Reach out to me directly and I’ll set you up with a few of my favorites.

Advantage Score is a model that the credit bureaus designed and sold. The problem is, no creditors use the Advantage Score model. Car dealers, mortgage companies, and just about everyone else use a Fair Isaac model of some sort.

You probably don’t want to monitor your credit progress with a scoring model nobody else uses so be sure your monitoring service is not owned by the credit bureaus and that way you get more accurate scoring and better pricing. Again, reach out to me directly and I’ll share my favorites.

If repairing your credit, you will be able to easily compare your reports month-to-month with these monitoring services. You will be able to see what was on the reports and then see the items deleted or updated on the newer reports. You can then plan out your next round of disputes, so you can see more improvement in the next 30 to 45 days.

Signing up for a monitoring service is a good idea to keep an eye on your credit reports. At the very least you should obtain your free report each year from www.annualcreditreport.com.

How to Receive and Read Your Report

Once you have a copy of your credit report, the next step is reading and interpreting all the data on your report. The more you know the better you can monitor your reports for errors, so you can dispute any inaccurate information.

After you sign up for a credit monitoring service, sit down with your credit report. Go through your report section by section, and highlight all the negative items you want to address in your disputes.

You can also sign up for a credit monitoring service and receive a free report for 30 days. But you will be required with most to give your credit card information, then auto charged after that indefinitely, until you cancel.

These reports will update every 30 days, giving you constant access to your reports. This is great for constantly monitoring your credit for updates, changes, and errors.

There are many of these services credit monitoring services out there. Reach out to me directly and I’ll set you up with a few of my favorites.

Advantage Score is a model that the credit bureaus designed and sold. The problem is, no creditors use the Advantage Score model. Car dealers, mortgage companies, and just about everyone else use a Fair Isaac model of some sort.

You probably don’t want to monitor your credit progress with a scoring model nobody else uses so be sure your monitoring service is not owned by the credit bureaus and that way you get more accurate scoring and better pricing. Again, reach out to me directly and I’ll share my favorites.

If repairing your credit, you will be able to easily compare your reports month-to-month with these monitoring services. You will be able to see what was on the reports and then see the items deleted or updated on the newer reports. You can then plan out your next round of disputes, so you can see more improvement in the next 30 to 45 days.

Signing up for a monitoring service is a good idea to keep an eye on your credit reports. At the very least you should obtain your free report each year from www.annualcreditreport.com.

Personal Profile

Every credit report has a personal profile section.

This area covers your current and past addresses and employers, your date of birth, and AKA information. You will first want to start by looking at the spelling of your name and your other aliases. You will probably want to dispute any aliases you don’t want on your credit report.

In many cases, these aliases are the result of people pulling your credit report and misspelling your name. You might apply for a car loan and when they initially pull your credit, there might be a letter off when they enter your name. The credit bureaus link to your report based on your social security number and this results in an AKA or alias appearing on your credit report.

You probably won’t want that on your report for the rest of your life. So dispute any of those aliases that you may want off your report.

You will also want to look at your address information. If there are previous addresses you don’t want listed on your report, addresses you are not familiar with, misspelled addresses, or even relative’s addresses, you will probably want to dispute those items to have them removed. Follow the same process with your employment information.

Dispute any inaccurate and unwanted information that appears on your report. Ensure that your name is spelled correctly, your date of birth is correct, and that your social security number is listed accurately.

Take your time and really review this section of your report. This will help reduce identity theft and ensure your credit doesn’t get mixed up with others, which is a common occurrence.

Inquiries

An inquiry is left on your credit report when you apply for new credit. The creditor requests a credit report from the credit bureaus and an inquiry from that creditor then shows on your report. There are a few concerns you should have about inquiries. They do reveal spending patterns and there are lenders who look at this when making lending decisions.

If your report shows a lot of inquiries for credit cards in a short period, a lender offering a car loan might see you as a higher risk or they might look at your inquiries to see where else you have been shopping or to see if you have been previously denied.

Employers even look at your inquiries to see what patterns might stick out. In a tough employment market, you don’t want inaccuracies showing up on your report because your future employer may be reviewing your spending habits before hiring you.

The amount of new credit you apply for accounts for 10% of your total credit score. This aspect of your credit score is based on the inquiries on your report. If you have a lot of inquiries in a short period of time, your credit scores will decrease.

If you go out next week and apply for a Capital One credit card, your credit scores might decrease one point on an 850 point scale. If however, you apply for seven credit cards next week; your scores might drop twenty points due to so many inquiries. This is just one more reason you might want to dispute your inquiries and have them deleted.

Summary Section

Each credit report has an account summary section that outlines your entire report. This section shows lots of details including how many accounts you have open, closed, revolving, installment, real estate, debt outstanding, debt in collections, and more.

Take a look at each section; do the balances owed on accounts look correct? Look at the closed and current accounts; do those numbers look accurate? In this section you will also want to compare the different credit bureaus’ information. Here you will typically see many differences. Be sure to investigate those differences as you review your report.

Don’t be surprised to see huge differences in what the credit bureaus report. The total amount of open and closed accounts, debt you owe, even balances and payments on individual accounts, are almost always reported inaccurately.

Pay close attention to the derogatory section of the summary. Look at inquiries, public records, collection accounts, current and prior delinquencies. This is a good section to also monitor your overall credit progress if you are disputing any inaccurate information.

Account History

Many reports break down your account history into account types. One section might be dedicated to real estate accounts, then revolving accounts, installment loans, public records, and any other categories for other account types.

Look through each section in detail and you will find the creditor’s name, account number, date opened, monthly payment, high balance, past due amount, and balance owed for each account.

Each account shows an Account Status such as open, closed, or unpaid collection. The account type reflects what kind of credit account it is frequent names used here are Installment, Mortgage, or Revolving.

Many times, this data is inaccurate and can have a big impact on your credit score, so ensure the details are accurate. Also review your Payment Status for more details on your accounts. This will show if it is being reported as a collection, 30 days late, or even paid as agreed.

The 24 month payment history reflects your payments for the most recent 2 years. Many monitoring service color codes this section, making it easy to spot your derogatory credit items. Look for 30, 60, 90, and 120 late payments. You will also want to look for collections or accounts reported as CO. Those are all damaging to your reports and items you will want to dispute if possible.

Public Records

Public records are all bankruptcies, judgments, tax liens, and all other public record types. This is one of the most harmful sections of your report and one that will demand your immediate attention. Review this section thoroughly. You will find the record type, court docket or account numbers, date filed or originally reported, and other important data that might be erroneous and need your attention.

Rarely, will you find that bankruptcies report accurately. Bankruptcies and the accounts in the bankruptcy will remain on your credit for ten years instead of seven years like other accounts. Judgments can remain on your credit for ten years or more. And tax liens can stay on your credit, indefinitely. So you will want to pay very special attention to your public records section.

Public Records

Public records are all bankruptcies, judgments, tax liens, and all other public record types. This is one of the most harmful sections of your report and one that will demand your immediate attention. Review this section thoroughly. You will find the record type, court docket or account numbers, date filed or originally reported, and other important data that might be erroneous and need your attention.

Rarely, will you find that bankruptcies report accurately. Bankruptcies and the accounts in the bankruptcy will remain on your credit for ten years instead of seven years like other accounts. Judgments can remain on your credit for ten years or more. And tax liens can stay on your credit, indefinitely. So you will want to pay very special attention to your public records section.

All the other details

Each credit monitoring service has its own special sections of information they give you on your credit reports. These details are typically additional factors affecting your credit scores, detailed overviews of credit patterns, and details on more discrepancy items on your reports.

Take the time to review these sections as there is an abundance of information that is important for you to verify. If you have not recently obtained a copy of your credit report, stop reading this guide and please do so now. It is essential that you know what is on your report. This is the first step to ensuring you have a positive credit and secure your financial future.

Chapter 05

How Credit Repair Works

Credit repair is the systematic disputing of erroneous, inaccurate, and unverifiable credit data for the purpose of having the negative items removed.

The Fair Credit Reporting Act originally became law in 1971. This law allows consumers many rights, including the right to dispute inaccurate or unverifiable information on their credit report.

This law has gone through many updates, amendments, and changes over the last few decades.

Most recently, the Fair and Accurate Credit Transaction Act (FACTA) of 2003, added new sections expanding consumer coverage. FACTA permits consumers many rights, including the right to receive a free copy of their credit report each year.

There are also strong regulations on how creditors must deal with identity theft cases, fraud alerts, and how they must dispose of consumer information. Most importantly, the Fair Credit Reporting Act and FACTA allow consumers the right to dispute inaccurate or unverifiable information on their reports.

The exact language reads, “If the completeness or accuracy of any item of information contained in a consumer’s file at a consumer reporting agency is disputed by the consumer and the consumer notifies the agency directly of such dispute, the agency shall reinvestigate free of charge and record the current status of the disputed information, or delete the item from the file in accordance with paragraph (5), before the end of the 30-day period beginning on the date on which the agency receives the notice of the dispute from the consumer.”

There are also many other points and rights presented by the Fair Credit Reporting Act, allowing consumers to challenge the validity of their reports. Once challenged, it then becomes the creditor’s responsibility by law to respond to and validate those disputes. This law and language is the foundation of credit repair.

Credit Repair Effectiveness

Once you have a copy of your credit report, the next step is reading and interpreting all the data on your report. The more you know the better you can monitor your reports for errors, so you can dispute any inaccurate information.

After you sign up for a credit monitoring service, sit down with your credit report. Go through your report section by section, and highlight all the negative items you want to address in your disputes.

The Credit Repair Secret

Credit repair is extremely effective, but your results will vary GREATLY based on your knowledge and your methodology of how you dispute. If you just mail letters to the credit bureaus not understanding their OCR and E-Oscar computers, your results will not be disappointing.

The same applies if you dispute online with the credit bureaus. If you take this step, your results again won’t be very good. This is one of the main issues with credit repair effectiveness–the repair isn’t done properly.

There are MANY dos and don’ts when it comes to repairing your credit. You will have access to the knowledge you need and access to the most advanced dispute tactics in existence. If you follow this system, you should be able to have your erroneous, inaccurate, and unverifiable information removed from your credit reports.

What Makes Credit Repair Effective

In the past, credit repair methods included overloading the credit bureaus with letters. The hope was to mail lots of disputes to the bureaus, confuse the person entering the disputes, hope the creditor doesn’t respond in time, and the item gets removed.

These types of methods are rarely effective anymore. Even if items get deleted, they are usually put back on the credit report shortly thereafter. This is because the creditor has 30 days to respond to the dispute. If they don’t respond, the item gets deleted. But even if they respond 60 days later, the item can legally be put back on the report.

To effectively and permanently delete negative credit items, you have to ensure the item gets deleted because the creditor or credit bureaus made mistakes or can’t verify the item. Then the item will be deleted and stays permanently off your report.

The credit bureaus have gotten much smarter over the years. Most of the dispute process is now automated through two computer systems the credit bureaus use. These computers are the key to success in the dispute process, so understanding them is very important.

OCR

OCR is the first line of defense the credit bureaus use against your disputes. OCR stands for Optical Character Recognition and is used to read every dispute letter you send into the credit bureaus. The computer basically reads your dispute to uncover several things. First, it attempts to see if the dispute is legitimate or what they call frivolous.

The system also automatically categorizes the disputes and flags disputes, creating stall tactics if they feel you are actually trying to improve your credit instead of just disputing one account you might have a question on.

OCR also stores these disputes in a detailed database and auto categorizes disputes with a dispute reason code. This way, you can’t dispute again for that same reason or it will not be investigated and instead called “frivolous”.

OCR is designed to reduce credit bureau human error and to ensure your disputes are stalled or voided at any chance it gets. It will even read your letters, including the font, paper, color of font, spelling, and other variables to try to see if you have used that letter before, OR if you are using a template letter to dispute.

If OCR thinks you are using a template letter which has been used before or sees another dispute for the same account with a similar reason, it marks it as frivolous and won’t investigate the dispute. If it does accept your dispute letter, it auto categorizes and processes the dispute with no human intervention.

This is EXACTLY why you NEVER want to dispute online. Part of the success of disputing is to create confusion with the creditors and the bureaus. When you dispute online, you remove humans from the process. This makes it much easier for that dispute to be validated and for the item to remain on your report.

Disputing online is basically spoon feeding OCR. The credit bureaus love it, which is why they make it so convenient for you. But your results will substantially suffer, and your results will be much worse if disputing online.

OCR is also the reason you don’t want to just send in letters to the credit bureau, not knowing what you are doing. If you dispute for a similar reason twice, the item is then listed as frivolous, making it very hard to dispute again. The same applies if you are using a common dispute letter or a credit repair company who doesn’t custom tailor their disputes.

If OCR picks up these things, your dispute results will suffer greatly. It will then make it much harder to ever get those items deleted.

Success with OCR

Some of our company dispute letters look like they were done by kindergartners. Yes, we do even use crayons and markers to write out some letters. We ALWAYS misspell words and enter some sentences that make no sense. We even dispute in Spanish and French when we can.

You want to use any method you can use to confuse OCR and get your disputes in front of an actual person. There are many ways you can accomplish this.

One of the first successful methods you can use is to do your disputes on heavy stock paper. Using “card stock” paper is a great method because OCR cannot be fed this thickness of paper. In using this paper, you almost automatically get your disputes in front of a human being.

ALWAYS change your fonts on your letters if typing them out, and change the color of your fonts. Make sure you misspell words so the disputes don’t look like they are coming from a professional credit repair company. And enter wording and sentences that don’t make sense, in an attempt to confuse OCR.

It is always a great idea to hand-write your dispute letters. This is one of the best proven methods to get your letters to bypass OCR. In hand-writing your letters, there are several other methods you can use to get past OCR. Use markers and crayons to do the disputes. You can also use pen and pencil, but make sure you misspell words and add sentences that don’t make sense.

That is your main goal in disputing to the credit bureaus, bypass OCR, and get your letters in front of a human being for maximum success.

e-OSCAR

e-OSCAR (Online Solution for Complete and Accurate Reporting) is the web based automated dispute system used by all three credit bureaus. This is the computer where the credit bureaus input disputes and those disputes are then delivered to the Data Furnisher or creditor who the dispute is for.

Again, the success in disputing has mostly been human confusion and error. e-OSCAR is one more way the credit bureaus automate the process to eliminate human error. e-OSCAR reads your dispute and assigns a 2-digit reason code. This reason code is the reason for the dispute, i.e., the account is not yours, you were never late, etc.

This code is the ONLY content that is pulled out of your letters, and the only content your creditors and the bureaus care about. They look at what account you are disputing and why or the reason for the dispute.

It doesn’t matter if your letter comes from an attorney or that you outline a big sob story to the credit bureaus. OCR or a human at the credit bureaus gets your letter and only enters the REASON for your dispute in a code format.

This is the only information the creditor then sees. They know the account that is being disputed, the consumer who is disputing it, and the 2 character reason code for why the account is being disputed.

The creditor then validates the account as accurate, acknowledges that it is incorrect and deletes, or doesn’t respond at all within 30 days and the credit bureaus delete. Again, all the creditor has to do is verify their account on their end and in one click validate the item, if accurate.

With the use of e-OSCAR documentation supporting your case, it isn’t even sent to the creditor. There have even been court cases against the credit bureau in this matter, due to their complete lack of real investigation into the process.

In those cases, Cushman vs TransUnion and Stevenson v. Trans Union to name two, the credit bureaus lost due to them basically copying the creditor’s information instead of actually investigating.

This E-Oscar automation eliminates most of the actual investigation altogether and most human errors on both the credit bureau and creditor sides are also eliminated.

Success with e-OSCAR

The best way to be successful with e-OSCAR is to use the methods mentioned in the prior Success with OCR section. These methods will get your information past OCR into a human’s hands. The “investigator” will then input the information manually into e-OSCAR, which is your first window for an error to be made and the closest you will come to an actual and real dispute.

You might also want to consider disputing multiple erroneous, inaccurate, and unverifiable accounts all at once. If the dispute is handled by a human, this method should increase the probability of a deletion.

Chapter 06

How to Dispute Errors on Your Credit Report

Every study I have ever seen shows at least 73% of credit reports have errors. Rarely have I ever reviewed a report with a client where we didn’t locate erroneous or false reporting accounts and I have never had a client who had an error in their favor, never. All “mistakes” on my clients’ reports were oddly mistakes against them, mistakes that hurt their credit, and none were “mistakes” that actually helped them.

A client just last week was telling me he reviewed his reports and that the reported negative accounts looked like they should be on there. I suggested we review his report together so we sat down to do an item by item review. After review he was shocked at what was on his report when we really looked at it with a fine tooth comb together.

As he had said, most of the accounts that were on there initially looked correct to him. We looked closer and a whole other story began to appear. Several of those items had incorrect date-of-defaults, a couple others were duplicates with the account numbers slightly modified, and another one had the account balance over $9,200 higher than it should have been.

At a quick glance, those errors would be overlooked and once they are recognized, many people still don’t know the huge impact those small “mistakes” make to their credit scores. Dates-of-last activity and dates-of-default drastically affect the credit score and the statute-of-limitations on how long the creditor can pursue you for the debt.

Misreported balances on old collections or high-credit-limits which are reported lower have a very adverse effect on your scores. In addition duplicate accounts on your reports means you get the same debt counted against you twice.

I have a lot of clients who feel they made mistakes and deserve to pay the price by having the negative items on their report. I completely respect that but it still pays to sit down and take a close look at your reports. When doing so, you will most definitely find plenty of mistakes, and when disputed, most of those errors will be completely deleted.

Remember, you are the only one in the credit system who benefits by your credit profiles being correct and accurate. If you review your reports, you will most likely find minor inaccuracies that have a significant negative effect on your credit scores.

The Fair Credit Reporting Act gives you the right to dispute inaccurate items on your report. Don’t forget this law was founded due to blatant dishonesty and miss-use of consumer information by the credit bureaus. The bureaus have all been sued or charged since for violating those laws.

All this means you are the only one who can and will get involved to improve your credit and disputing is how you can do it. Disputing starts by sending letters directly to all three credit bureaus to challenge the accuracy and validity of the information on your reports.

The end of this chapter contains some dispute letters based on different reasons which might pertain to your situations. You should start your disputes by finding the errors on your reports and the reasons those items are not accurate. Then you can use or modify any of the letters in this chapter to fit your individual needs.

Dispute Reason Codes

We discussed e-OSCAR reason codes in the prior chapter. Each dispute must be for a different reason or the credit bureaus will mark it as frivolous and not investigate your dispute. FACTA does allow the credit bureaus to ignore frivolous disputes so you want to use the letters we outline and don’t dispute the same account for the same reason.

For example, you can dispute Capital One due to it not being your account. Then your next dispute should be for something different, like that you never paid it late. And your next dispute should be yet for another reason, like the account number is incorrect. Of course, make sure you’re disputing legitimate reasons the account might be incorrect.

If you don’t change reasons, the credit bureaus might return your dispute as frivolous. This would then waste a lot of time and reduce your chances of being able to successfully dispute and delete in the future. This is one of the many reasons you don’t want to just blindly send letters into the credit bureaus. If you do this, in many cases you actually ruin your chances of getting the item deleted the right way.

Our research has shown approximately 27 reason codes for the credit bureaus. These are 2 character codes for the different “reasons” you are disputing the account. The letters we provide you include separate reasons for the dispute. This way, each dispute is for a different reason, is assessed a different reason code by e-OSCAR, and this insures your disputes won’t be labeled as frivolous.

Dispute Them All or Just a Few

Many consumers wonder if they should dispute only a few of their negative items or all of them. We have found in extensive research that nothing is lost if you dispute all the accounts at once that you find to be inaccurate, unverifiable, or erroneous.

Remember, OCR usually inputs the disputes into the e-OSCAR computer. If you are using the tactics we advise with OCR, your disputes might even get input by a human at the credit bureaus, allowing the possibility for more errors.

Either OCR or a human will pull your dispute out because you dispute too many accounts. In both cases, the goal is just to get the disputes in the system fast so they can quickly get forwarded to the creditor.

So even though OCR or a human bureau investigator will see your dispute letters, your letters won’t be stopped if you are disputing multiple accounts at once. Those disputes, once entered into e-OSCAR, get sent to the creditors individually. So your creditors won’t know either that you are disputing all your accounts at once.

For this reason, you should consider disputing five or more accounts with each round of disputes. You can even include those disputed accounts on the same dispute letter you mail to the credit bureaus. By disputing more accounts with each round, you will see results much faster.

Since you don’t lose any effectiveness with multiple accounts being disputed, consider doing this with each round you dispute. Always try to dispute 5 or more accounts with each round of disputes. You can put all these on the same dispute letter, so don’t waste your time completing separate letters for each disputed item.

You can only have one active dispute being investigated at a time. So this would cause an issue if you mailed out multiple letters for each individual account. Dispute multiple accounts on the same letter and you will still see very nice results.

What to Include with Your Dispute Letters

There are several things you want to insure are included in every dispute letter you send. Make sure every dispute letter contains the accurate spelling of your first and last name. You should also include your social security number and current home address.

The credit bureaus will NOT dispute unless they KNOW it is you doing the disputing. Your social security number is the main way the bureaus link your disputes to your credit report. This means you must clearly identify yourself in your letter, with your social security number provided.

The credit bureaus will also require you to supply supporting documentation verifying your identity. They want to see your Driver’s License and Social Security Card. They will NOT investigate your disputes without this supporting documentation, so include it with each round of disputes.

If you don’t have a driver’s license, include another legal form of ID. This can include a passport or state ID. If you don’t have a Social Security card, provide another form of ID with your social security number on it.

In many cases, you can use a pay-stub or W2 form which has both your name and social security number on them. Just insure you do supply a picture ID and a document verifying your social security number to ensure your disputes are investigated properly and quickly.

You should also include the account name and account number on the dispute letter. List the creditor’s name and the account number they are reporting to the credit bureau. Sometimes creditors report separate account numbers to each bureau. Look at each account number for each credit bureau you are disputing. Make sure you have that creditor’s account number correct on your dispute letter.

Finding the Best Dispute Letter to Send

The main difference with credit bureau dispute letters is the reason in the letter for the dispute. Remember, you must dispute each time for a different reason to avoid the dispute being labeled as frivolous.

Find the best letter for the reason for your disputes. Is the account yours? Did you pay it late? Does the account belong to someone else? There are many reasons for the letters, just pick which one you feel works best for your situation.

If you dispute the account and the creditor verifies that the account is accurately reporting, you will need to dispute again for another reason for something you have found to be inaccurate.

Remember, you are making the creditor verify the information they are reporting as they are required to do so by law. If the creditor doesn’t have a record of the account anymore, they won’t respond or will tell the credit bureaus that it should be deleted.

If you do CLEARLY know the account is not valid for a particular reason, dispute for that reason and include any supporting documentation you have. This supporting documentation will not be supplied to the creditor with your dispute, but it does help show the credit bureaus that you can prove your case.

Don’t be surprised if you dispute an account you KNOW is inaccurate, then see that the account is verified. Keep in mind, the creditor doesn’t see the evidence you send in with your disputes. You might need to follow our dispute process and send out a few dispute letters; even direct creditor letters to get the item deleted.

It is important to keep disputing for different reasons the account is inaccurate or erroneous until you find a reason they can’t verify. If they are verifying the account with these disputes, advanced debt validation techniques should then help get those items deleted. You will learn more about these advanced methods in the following chapter.

Complete and Mail Your Dispute Letter

Now you have all the fundamentals in the dispute process. It is time to get your disputes and get them in the mail. Sit down with your credit report to review your negative items. You can then log those items in a log for tracking.

Next you will want to choose the best dispute letter. Dispute the reason the account is not accurate, erroneous, or unverifiable. Complete the dispute letter with your account and personal details. Make sure you include your name, address, and your social security number on the dispute letter. Also make sure you sign the letter.

Ensure you complete the creditors’ names and account numbers which you are disputing. Make sure you have the correct account number that is listed on your report for the bureau you are disputing. Remember, account numbers might vary between different credit bureaus.

Include your IDs with your letter. They will want to see your Driver’s License and Social Security Card. If you don’t have those, supply another state or federal picture ID and additional verification of your social security number.

Mail your disputes to each credit bureau. The credit bureau addresses are listed later in this chapter. The first address listed is the primary address for each credit bureau.

There are also many more addresses listed for each bureau. Log the date you mail out your disputes.

Waiting for and Checking Your Results

It will take between 30-45 days for you to receive results. In many cases, it will take 40-45 days. Sometimes you will receive results faster, but expect to see them after 40 days. If they do arrive early, you can then be pleasantly surprised.

The Fair and Accurate Credit Transaction Act gives the creditor 30 days to respond to the dispute. This means they have 30 days from the date the dispute is entered by the credit bureaus into e-OSCAR.

You should allow time for the disputes to get mailed to the credit bureau and allow for some time for the bureaus to initiate the dispute. This is why 40-45 days is a god expectant time-frame to wait for your results.

FACTA requires the credit bureaus to respond to you by mail with your results ONLY if you request they do so in writing. Ensure that you include a sentence on the credit bureau dispute letter requesting that they reply to your dispute by mail. They then are required by law to mail you back your reports.

The credit bureaus will then send you copies of your credit reports by mail. These reports will come in larger than normal envelopes with only P.O. Boxes in the return address section. You will be able to see your results on the first page of most reports you receive, but each bureau’s report looks a little different.

TransUnion

TransUnion reports are very easy to read. Their results are on the first page and appear as a list. The list shows you the account name, account number, and the result. You hope to see Deleted. Sometimes you will see VERIFIED, NO CHANGE and other times you will see NEW INFORMATION BELOW.

When the report shows that new information is on the report, it is usually a minor correction to the reported data. The negative item probably still remains, but has been modified. Sometimes this change is the date of last activity, or the balance owed, or whatever other factor you disputed the creditor for.

Experian

Your results can be on your Experian reports on page 1 or 2. They also provide you with a list summary of your results. This list shows the account name, account number, and status. The status is either “Deleted”, “Remains”, “Updated”, or “Reviewed”.

You are shooting for a “Deleted” result. “Remains” is the worst result, as this indicates the item will stay on the report with no change at all. If the account is “Updated,” a change was made to the item but it remains on your report.

If you disputed that the item belongs to you, this status will indicate that they verified it does belong to you. If you disputed the account for another reason, review the report for what was changed. “Reviewed” simply means you need to check the report yourself for results. It can indicate either a deletion or update. You won’t see too many of this result type.

Experian will provide you other account details in the report they send. These details include the creditor’s name, address, and phone number. You will also see the account number and date originally filed. Many other account details and notes on the account are all available on this report.

Equifax

Equifax reports don’t really have a good summary section. You will have to review the account details on your report to see what has changed. They do typically show you the update and deleted accounts first on the first two pages of the report. These are under “The Results of Our Investigation,” and “Collection Agency.”